豪情满怀共赴百年之约——西南财经大学2025年新年贺词日月春晖渐,光华万物新。当零点的钟声响起,柳湖...

12月27日下午,中国共产党西南财经大学第十四次代表大会第二次全体会议在弘远楼105会议室举行。大会应到...

12月26日,中国共产党西南财经大学第十四次代表大会在弘远楼105会议室隆重开幕。大会应到代表244人,实...

1月29日,乙巳大年初一,党委副书记、校长李永强带队看望慰问春节期间坚守在工作一线的值班员工,代表学...

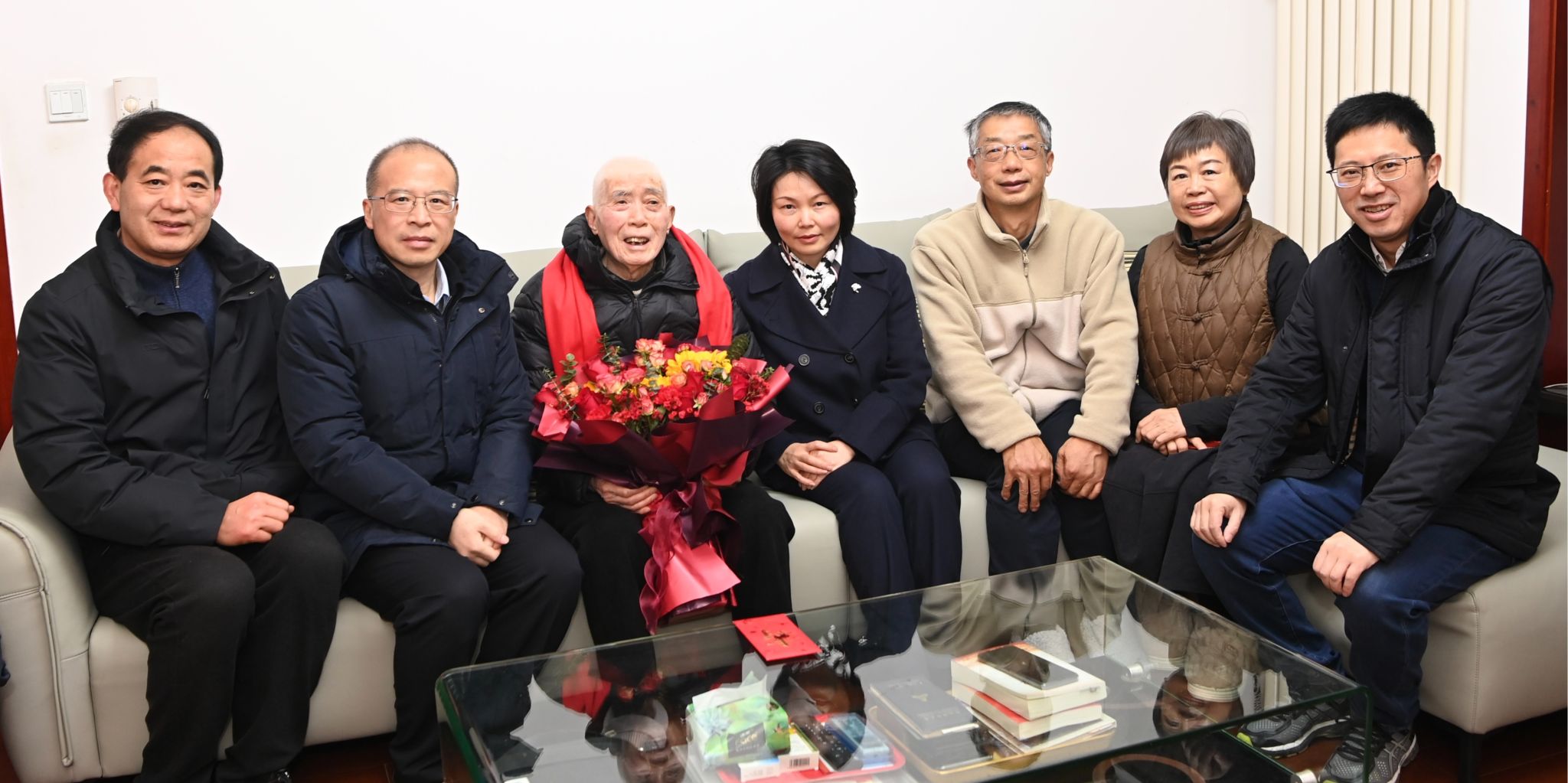

期颐之年福泽厚,松鹤长春岁月悠。时逢岁末新春,学校离休干部钱立迎来百岁寿辰。1月27日,学校党委副书...

金龙呈祥辞旧岁,灵蛇献瑞迎新春。1月25日,学校在柳林校区教工食堂举行2025年寒假留校学生新春团拜会。...

1月19日,西南财经大学印度尼西亚校友会成立大会在印度尼西亚雅加达市举行。中华人民共和国驻印度尼西亚...

2025年新春佳节来临之际,学校党委深入开展走访慰问活动,向老领导、老教授、老党员、病困党员送上组织...

| 九州平台 |

| 外国语学院 |

| 外国语学院 |

| 数学学院 |

| 外国语学院 |

| 数学学院 |

| 特拉华数据科学学院 |

| 外国语学院 |

| 公共管理学院 |

| 管理科学与工程学院 |

| 九州平台 |

川公网安备51010502010087号

川公网安备51010502010087号